As the world braces itself for the economic impact of COVID-19, banks are looking to credit risk models in an attempt to quickly understand and forecast the effects of such rapid change. But putting these models to work is no easy task.

At its core, risk modeling is a field largely driven by reasonable assumptions and historical relationships in data – which are being turned on their heads in the face of the sharp and unprecedented events that have unfolded during the early stages of this pandemic. And sure enough, as the pandemic spreads, most banks are finding that traditional loss forecasting models are quickly breaking down against these new external forces.

Banks will need to react quickly to a set of unique challenges if they hope to protect themselves against the rising tide of risk. Time is of the essence, as initial assumptions will serve as the cornerstone of credit decisioning amidst the current crisis, informing subsequent steps to mitigate further risk in the coming months.

In the following post, we’ll lay out the various challenges facing banks and the tools they’re using to inform forecasts.

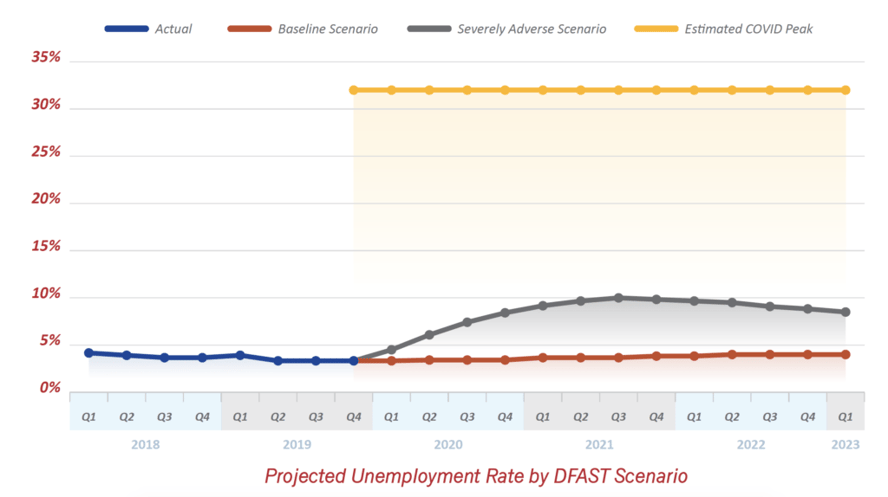

Especially in the face of a global pandemic, it's essential that banks start with well-grounded economic assumptions. In all likelihood, banks that are required to perform DFAST and CCAR stress tests are turning to those models, alongside the severely adverse scenario provided by the Fed, which borrows characteristics from the 2008 housing crisis. But these scenarios alone, are unlikely to produce an accurate representation of the increased risk because of the fundamental differences between this and previous recessions.

A few key differences that bear noting:

Moody’s pandemic scenarios (as of March 27th 2020)

In many ways, a model is only as good as its training data – the observed historical relationships which are used to construct a statistical model. But in the case of the COVID crisis, which has proven itself to be a unique actor, it’s likely that loss forecasters will run into trouble, even if they can arrive at perfect economic foresight over next several quarters.

For banks that weathered the storm of the Great Recession, a wealth of information exists on the relationship between economic downturn and borrower behavior in their portfolios. It is common for risk modelers to leverage this information, when available, to build the economically sensitive models which are needed for regulatory stress testing. But when the drivers of recession are different – a housing crisis versus a highly contagious health threat – and the regulatory environment is dramatically changed, it is likely these relationships will no longer hold and thus models will not perform as well.

For instance, while credit risk during the Great Recession was highly correlated with home prices, a recent study conducted by Zillow concluded that home prices are more likely to freeze during a pandemic than see dramatic drops, as it is harder for prices to change when there are few transactions. Additionally, government moratoriums on foreclosures and the additional direction to offer assistance on mortgages backed by Freddie Mac, Fannie Mae, or the Federal Housing Administration will likely keep the bottom from falling out in the same way as 2008. Lastly, regulatory changes in credit reporting and the transition to a digital marketplace may change the historically observed relationships between borrower characteristics, the economy and overall credit risk.

Every modeling framework must make certain assumptions, and these assumptions connect a loss forecasting model to an underlying business use case. As these assumptions change, predictions made by these models may drastically change as well. In a worst-case scenario, a change in a model assumption may break down the system entirely.

Loss forecasters will need to evaluate the risks of underlying assumptions changing in the face of COVID and deeply understand the effects it could have on their credit loss estimation system. And while government relief programs or changes to internal policy may provide support to those directly impacted, they may become a significant roadblock to arriving at a timely estimation of losses.

Internal policies often ground the underlying assumptions that models are built upon and could be baked into the most foundational aspects of the way it’s constructed. So, when a bank adjusts its delinquency or charge-off policies, for instance, the deferral program that freezes account status could render models relying on the flow rate between delinquency buckets unusable.

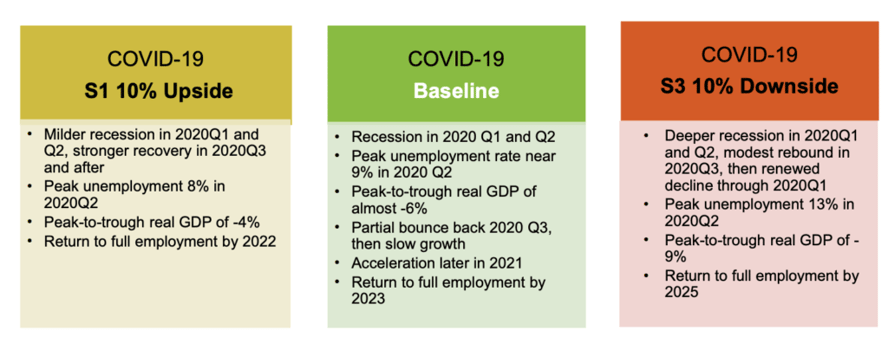

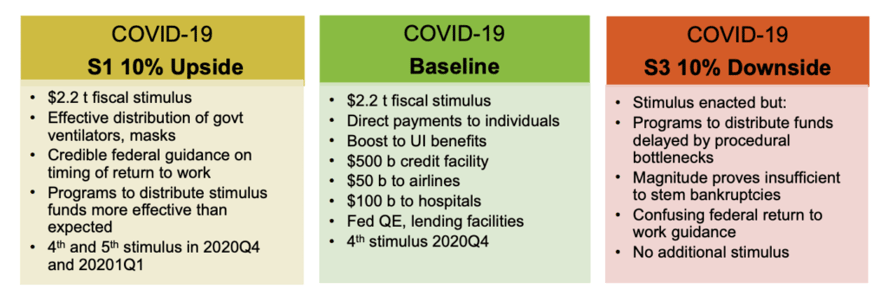

And when we expand that universe to federal and state governments, we introduce yet another layer of uncertainty. Moody’s Analytics estimated a range of policy scenarios that could arise over the next several months, which are by no means representative of the entire range of outcomes. These policy decisions could easily sway the resilience of specific subsegments of the bank’s overall portfolio (i.e. stimulus payments to individuals could shift risk away from individual consumers) and/or create changes in borrower behavior (i.e. the lack of evictions results in borrowers prioritizing paying off credit card debt over home loans).

Moody’s policy scenarios (as of March 27, 2020)

Unless you’ve been under a rock for the last 12 years, you understand the pace of the digital marketplace, something that existed to a far lesser extent during the Great Recession. This go-around, banks will need to ensure that their credit risk models are robust to rapid change and new risk splitters.

Static models traditionally used in credit risk modeling are oftentimes built on a fixed population of loans, to draw predictive power from historical relationships. Under this framework, as new data flows in from month to month, traditional frameworks may not incorporate the newest information into the build population of the loss forecast. In this way, newly revealed relationships buried in the latest data may be overlooked. Models that do not take the latest information from the COVID crisis into account may not be robust to the changing environment and could see significant misses in identifying previously unobserved relationships.

Banks that have not reevaluated model inputs to include information related to the digital banking age may also face roadblocks in adapting to the current crisis. For instance, with an increased number of people sheltering in place, banks may see a dramatic rise in digital banking activity. Models that do not include information related to digital banking may miss obvious risk indicators that could otherwise be captured by this information. To that point, banks may want to consider adjusting which data features are examined during their credit risk analysis, particularly with data which may not have existed or been relevant during the great recession.

The speed at which COVID threatens to affect the economy makes this a truly unprecedented crisis. Whereas standard forecasts of economic stress from the federal reserve often take place gradually over several quarters, COVID threatens to affect rapid change over the span of just a few months. Because of this pace, it’s inevitable banks will feel the pressure of delivering quick insight into the various impact points of the crisis on their overall exposure to risk.

As is the case with large, unwieldy organizations, banks are bound to run into bottlenecks with making rapid updates to key processes across multiple scenarios. And even those with highly automated processes may be insufficiently resourced to run models at the pace of change or struggle to meet regulatory assurances from second second-line teams.

Given the mountain of challenges and variables that lay before us, it’s likely that banks will need to lean heavily on heuristics, back of the envelope calculations, and subject matter expertise to apply judgmental overlays to existing models. This will allow for the newest insights to be more quickly incorporated, as opposed to going through the lengthy model development process.

At this point in time, uncertainty reigns supreme. While banks are doing their best to make informed decisions, at the end of the day it’s still anybody’s best guess just how bad things will get. In the meantime, banks should place particular focus on quickly assessing the data and assumptions that their credit models are built upon and work to take them into account during their COVID analysis.

It is inevitable that loss forecasters will find weaknesses bubbling up in most models during the next several months, some of which are unexpected. Relying on a range of outcomes will be key to avoid over hedging on a specific methodology, and banks should aim to evaluate risk through a suite of different models and heuristics that cover each other’s blind spots.

Now more than ever, it is important for model development teams and business experts to form deep relationships to accurately understand how companywide and government policy will affect loss forecasting models. In times where forecasting becomes more difficult, banks with well-established processes for quickly monitoring credit at a daily level and then translate that knowledge into decisive action will be better poised to ride the rising tide of risk.

Many believe it is inevitable that COVID will leave a long-lasting impact on the world, lingering after the pandemic ends. And while we can’t foresee the endpoint, it is a certainty that this shift will also transform the way banks approach credit risk modeling, and that the imprint of this event will live on in risk management for many years to come.

Let's Talk

Like how we think? Subscribe to have our articles delivered direct to your inbox each month.

Headquarters: 8000 Franklin Farms Drive, Suite 100, Richmond, VA 23229

©2026 Spinnaker Consulting Group. All rights reserved.